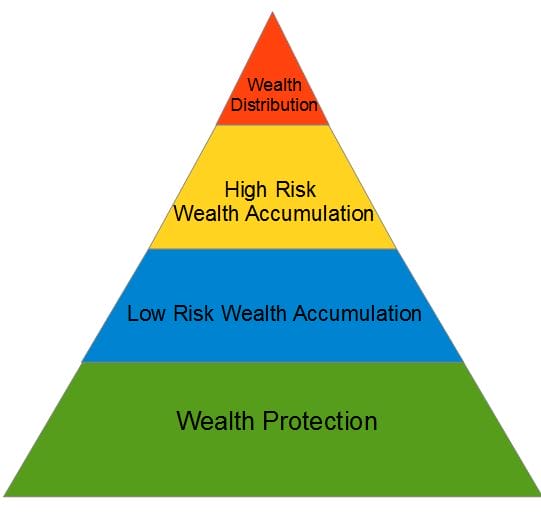

The Financial Planning Pyramid Is Your Road Map To Financial Freedom

The road map to financial freedom can be summed up with the simple picture above. You can work hard and earn boat fulls of money, but unless you have a plan for what you’re going to do with that money, you won’t be financially successful in the long term. The financial planning pyramid shows us the path to financial freedom.

The concept of the financial planning pyramid is that you start at the bottom, building a financial foundation. Once you have implemented the components of one level, you move to the next one. Each level building on the one below it.

Wealth Protection

It will be difficult to build new wealth if you have to continuously dip into current assets. For that reason the first level of the financial planning pyramid is to protect your wealth. Things included are methods that will help you hand the unexpected things in life that might derail your long term financial goals:

- Medical Insurance : This can help pay for costly medical bills which could quickly drain your savings and investments if you or a family member has a medical emergency.

- Life Insurance : If your spouse or partner contributes a significant amount of the household income, an unexpected death could derail your own long term financial goals. Life insurance can not only help pay for funeral costs, but also help ensure you’re not left with debt you can’t pay, or not enough income to maintain your lifestyle.

- Emergency Fund: Even small day to day unexpected expenses such as having to pay for car repairs can cause a constant drain on your investments and savings.

- Wills : Should something unexpected happen, you want to make sure that it is legally clear to whom your accumulated assets should be given.

Wealth Accumulation

Once a person as their assets protected, they can begin building additional wealth. One starts with low risk, low return methods and gradually moves up the financial planning pyramid to higher risk but higher reward means. As a person’s wealth grows, the more comfortable they can be with a higher degree of risk since their basic needs for the future are met through the funds in the lower risk categories. Some examples of wealth accumulation are listed below.

- Savings : Once you have your emergency fund funded, you can start putting funds into less liquid, higher return savings accounts such as a Certificate of Deposit (CD).

- Home Ownership : For some people, owning a home is not only a life goal, but also an investment. A person gets use and enjoyment out of the home for many years by living in and building a life in it. However, when retirement age nears, one my decide to sell and downsize, reaping significant equity.

- Retirement Accounts : Contributing the maximum allowable amount to retirement accounts such as 401K and IRAs have tax benefits and in some cases matching employer contributions that can help maximize the growth of your investments.

- Real Estate : Purchasing real estate can not only be a good way to build wealth through value appreciation, but also a means of passive income if the property can be rented to others.

Wealth Distribution

It is important to have a plan in place to pass along the wealth you have worked hard to accumulate to your heirs. Depending upon the laws in place where you live, estate taxes could take away a sizable amount of the wealth you earned and have already paid taxes on. For the wealth distribution level of the financial planning pyramid, consulting a professional may be a wise choice to help ensure as much of your wealth as possible is passed along to your loved ones.

You’ll also need a broker if you want to own securities. There a number of good full-service ones out there: Schwab, Fidelity, Chase, etc. Also, there are several good new money management companies which may be worth reviewing. These are Personal Capital (I like them), Wealthfront and Motif Investing. Modestmoney.com has a good review of Motif Investing which is worth reading (here).

Successfully managing your personal finances and building wealth is a challenging endeavor, but the financial planning pyramid provides a guideline for what actions need to be taken, and in what order to build a life of financial freedom and pass it along to the next generation. What level of the financial planning pyramid are you currently on? Did you skip any of the levels?

Brought to you courtesy of Brock