How To Fix Your Credit With These 8 Strategies

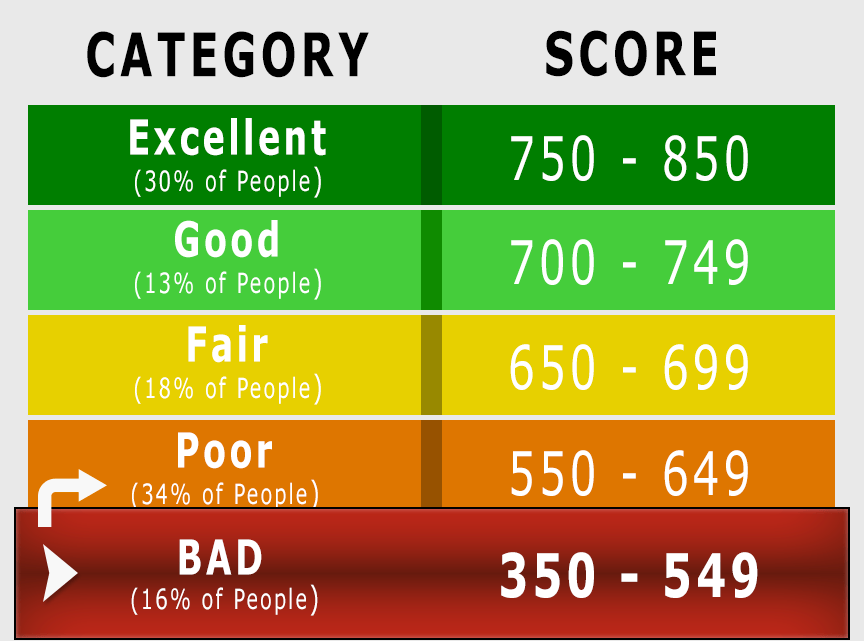

Repairing your credit score may seem like a daunting task, but with a bit of discipline, planning, and persistence, it’s entirely possible to rebuild your financial reputation. A healthy credit score is essential for securing loans, obtaining favorable interest rates, and even landing certain job opportunities.

This blog post will provide you with eight practical strategies to help you fix your credit and regain control of your financial future

Obtain Your Credit Report And Review It Carefully

Start by obtaining a copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion). You are entitled to a free report from each bureau every 12 months. Carefully review your credit reports, looking for any errors or discrepancies. Identifying and rectifying mistakes is the first step toward repairing your credit.

Dispute Inaccuracies On Your Credit Report

If you find any errors or inaccuracies on your credit report, you should dispute them with the respective credit bureaus immediately. Provide documentation supporting your claim, and follow the bureau’s dispute resolution process.

Rectifying these errors can have a significant impact on your credit score. To make this even easier, consider using highly effective, pre-written credit repair letter templates.

Pay Your Bills On Time

One of the most important factors affecting your credit score is your payment history. Make it a priority to pay all your bills on time, every month.

Set up automatic payments or calendar reminders to help you stay on track. Timely payments will demonstrate to lenders that you’re a responsible borrower, gradually improving your credit score.

Reduce Your Credit Utilization Ratio

Your credit utilization ratio, which is the percentage of your available credit that you’re using, significantly impacts your credit score.

Aim to keep your credit utilization below 30%. You can achieve this by paying down your credit card balances and avoiding maxing out your credit limits. Maintaining a low credit utilization ratio shows lenders that you’re using credit responsibly.

Create A Budget And Stick To It

Developing a realistic budget can help you manage your finances more effectively and prevent you from falling behind on payments or accumulating excessive debt. Track your income and expenses, and identify areas where you can cut back.

By sticking to a budget, you can stay on top of your finances and gradually repair your credit.

Diversify Your Credit Mix

A diverse credit mix, consisting of various types of credit (e.g., credit cards, mortgage, auto loans), can improve your credit score.

Lenders appreciate borrowers who have experience managing different types of credit. However, it’s essential not to take on more debt than you can handle; only apply for new credit when necessary and when you’re confident that you can manage the repayments.

Limit New Credit Applications

While diversifying your credit mix can be beneficial, applying for too much new credit in a short period can negatively impact your credit score.

Hard inquiries, which occur when lenders check your credit during the application process, can lower your score. Limit new credit applications and focus on managing your existing credit responsibly.

Consider Credit-Building Tools

If you’re struggling to improve your credit score, consider utilizing credit-building tools, such as secured credit cards or credit-builder loans. Secured credit cards require a cash deposit, which serves as your credit limit, minimizing the risk for the issuer.

Credit-builder loans involve borrowing a small amount, which is held in a secured account until you’ve made all the necessary payments. Both options can help you establish a positive payment history and improve your credit score.

Conclusion

Fixing your credit score requires dedication, patience, and a focused approach. By implementing the eight strategies outlined above, you can take control of your finances and gradually rebuild your credit.

For more great Cleverdude articles, consider these:

Everything You Need To Know About Costco Cash Back Rewards

Bad Credit, consider saving money – Check out CleverDude’s series on saving money.

Check out Clever Dude’s consumer’s lament – the fatigue of buying and spending money.